Most investors are familiar with investment grade bonds: they’re IOUs from a company or government organization, with an agreed-upon interest rate (how much it will pay you) and maturity date (when it will pay you back your principal). What makes high yield bonds different is the lower credit quality of their issuers, as determined by various rating agencies. These bonds pay high yields to compensate investors for the higher-than-average risk that the issuer will default on the bond. Historically, interest rates on high yield bonds have averaged between 4 and 7 percent above “safe” bonds such as U.S. government Treasury bonds.

How to invest in high yield bonds

For most individual investors, the easiest way to invest in high yield bonds is by buying a high yield mutual fund or ETF. These funds lower your risk by diversifying your investment across a portfolio of high yield securities from many different issuers. By contrast, if you buy an individual high yield bond, it may default if the issuer does not pay the interest or principal as required. A bond’s price also will likely decline if the issuer’s credit rating is lowered, or because of unexpected news or financial results. High yield bonds can sometimes be less “liquid” than investment grade bonds, so an investor may have difficulty selling them at certain times, especially during severe economic downturns. All these risks of holding individual high yield securities can be reduced by instead buying a diversified high yield mutual fund or ETF.

The two most widely held high yield ETFs are iShares iBoxx High Yield Corporate Bond ETF (HYG), and SPDR Barclays Capital High Yield Bond ETF (JNK). These are both index funds, and are diversified by holding hundreds of different high yield securities. In the mutual fund category, we track over 700 current and defunct high yield bond funds. The oldest of these funds has been open to investors since 1950. Mutual funds also provide a good amount of diversification by holding high yield notes from many different issuers.

Benefits of investing in high yield bonds

To understand the attraction of high yield bonds, you need to look no further than the following table, which shows the current annual yield percentage of various Vanguard bond mutual funds:

| Symbol | Mutual Fund Name | Yield % |

|---|---|---|

| VBMFX | Vanguard Total Bond Market Index Fund | 3.09% |

| VIPSX | Vanguard Inflation-Protected Securities Fund (TIPS) | 3.77% |

| VWESX | Vanguard Long-Term Investment-Grade Bond Fund | 5.09% |

| VWEHX | Vanguard High-Yield Corporate Bond Fund | 7.51% |

As you can see, the high yield corporate bond fund pays out 4.4% more than the broad bond market index fund. In the current low interest rate environment, and with a rate of inflation above 3%, it’s no wonder that many investors have flocked to high yield funds. It’s worth noting that this particular Vanguard high yield bond fund (VWEHX) is relatively conservative compared to its peers, which have even higher yields. (Nominal yields for the high yield category were about 9.5% earlier this month.)

Aside from their high rate of current income, high yield bonds also have the potential for capital appreciation during good economic times, or if the debt is upgraded by credit rating agencies. Following the most recent economic crisis in 2009, several high yield bond funds more than doubled in value in about two years time.

Some investment advisors also recommend high yield bonds as a measure to protect your portfolio against inflation. For example, Rob Arnott from Research Affiliates recently referred to them as “stealth inflation fighters.” He opines that high yield bonds and other inflation-fighting asset classes should be an essential “third pillar” in an investment portfolio, and should be the “the largest and most central part of one’s portfolio mix.” [1]

Risks of investing in high yield bonds

So what about the risks and downsides? First, an inverse relationship exists between bond prices and interest rates, and high yield bond funds are no exception: their price declines when interest rates rise. High yield bond prices also decline during economic recessions. Finally, there’s a relatively high correlation between high yield securities and stocks. For this reason, many investment advisors discourage their use in favor of higher grade debt (like U.S. Treasuries), which provides more of a portfolio buffer during stock market declines. We’re getting ahead of ourselves a little, but most of these problems can be solved with a tactical bond allocation strategy.

Historical returns of high yield bonds compared to stocks

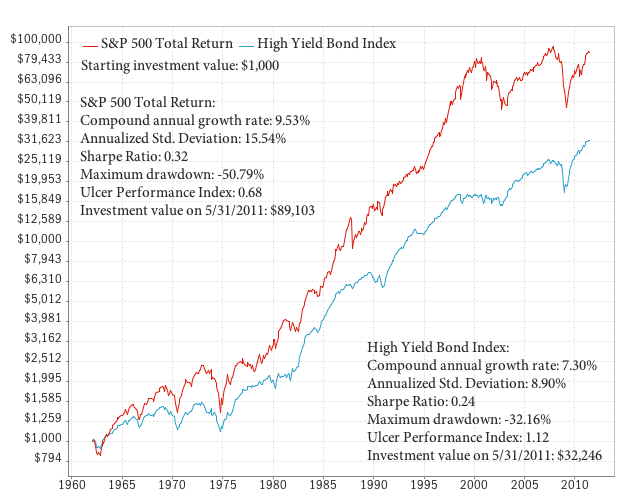

The following chart compares the historical return of high yield bonds to U.S. large cap stocks, since the 1960s:

Two things should be noted about this comparison:

- A high degree of correlation: valleys and peaks in U.S. stock prices often correspond to similar swings in high yield bonds. Notable similarities can be seen during the 1960s and 1970s, early 2000s, and the most recent financial crisis in 2008.

- The risk of investing in U.S. stocks has been disproportionately higher, i.e. high yield bonds actually provide better risk-adjusted returns, as measured by their Ulcer Performance Index (UPI) and Maximum Drawdown. By these measures, high yield bonds are therefore safer investments than stocks.

Still, with a decline in value of over 32% during the most recent financial crisis, high yield bonds aren’t exactly a safe buy and hold investment.

How to truly reduce risk in high yield bond investments

High yield bonds perform exceptionally well when combined with low volatility bonds in a tactical bond portfolio allocation strategy, such as the one we offer here at Yieldstream. Using this trend-following and relative strength based approach brings out the best in high yield securities, while also managing the downside risks. It’s one way to have your proverbial cake and eat it too: high current income and low volatility.

Notes

- Research Affiliates Newsletter — October 2011 “The long view—building the 3-D shelter”