There’s no single best answer to how to construct and manage a bond portfolio. There are several options that will appeal to different types of investors.

The simplest possible way to invest in bonds is to buy a diversified bond fund. For example, you can buy the Vanguard Total Bond Market Index Fund (VBMFX). This mutual fund replicates the investment performance of the Barclays Capital U.S. Aggregate Bond Index, which represents the broad U.S. bond market. Just by buying this single fund, you own a piece of its very diversified holdings: over 4,000 different investment-grade corporate and U.S. Treasury bonds. If you prefer exchange traded funds, Vanguard’s ETF equivalent of this bond fund trades under the ticker symbol BND.

Simplicity has its merits, but a slightly more sophisticated investor may want to add some protection against inflation, and some exposure to international and emerging market bonds. So in addition to the Total Bond Market fund, you can add some shares in Treasury Inflation Protected Securities (TIPS). If you prefer mutual funds, a good candidate to invest in would be Vanguard Inflation-Protected Securities Fund (VIPSX). If you prefer an ETF, you can buy iShares Barclays TIPS Bond Fund (TIP). To diversify in international government bonds, add SPDR Barclays Capital International Treasury Bond (BWX). And finally, for emerging markets, a good choice is iShares JPMorgan Emerging Markets Bond (EMB). These four funds (total bond market, inflation protected, international, and emerging bonds) provide a very well diversified bond portfolio.

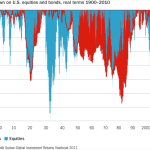

However, there are some potential problems on the horizon for this particular bond fund investing approach. Current bond yields are extremely low by historical standards: less than 3 percent for thirty year U.S. government Treasurys and bonds of equivalent investment grade risk. And according to the Bureau of Labor Statistics, the current inflation rate is 3.77% (for the most recently reported 12-month trailing period). At this rate, bonds are not even keeping up with the rate of inflation! Also, bond prices move in the opposite direction of interest rates, so when interest rates eventually rise, the total return of these bond investments could be zero or even negative. This would not be unprecedented. Between 1900-1980, U.S. government bonds had a real return (after inflation) of only 0.2 percent per year, as interest rates rose from near zero percent (during the Great Depression) to over 16 percent in the early 1980s. So much for bonds being a steady source of income!

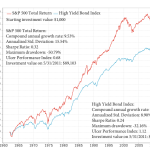

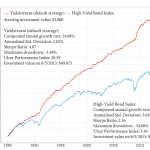

How do you increase the yield of your bond portfolio? One solution would be to add high-yield corporate bonds to the portfolio. And indeed, investors have been buying junk bonds in record numbers since early 2009. They can be a great source of income and total return. But they’re also extremely volatile, and can drop quickly in value when the economy deteriorates. That’s why it makes sense to use a tactical bond portfolio strategy. This allows you to hold high-yield bonds while they’re trending up, and to switch your allocation to safer, low volatility bond funds when market conditions call for it and there’s a change in trend.

Comments

To add a comment, please Sign In.