Yieldstream Strategy Performance (as of 1/23/2026)

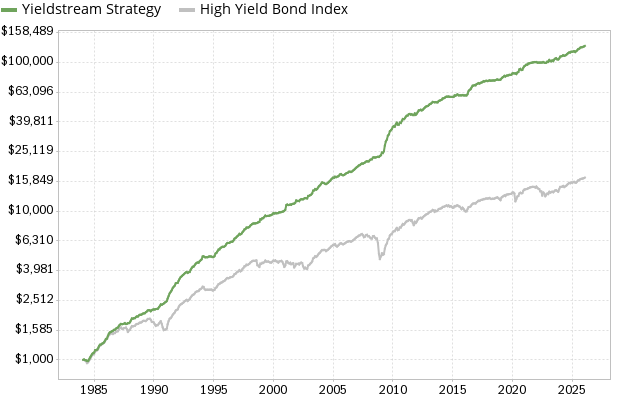

The chart below compares the performance of the Yieldstream investment strategy to a High-Yield Bond Index [2]. The Yieldstream strategy has been profitable every single year, with a compound annual growth rate (CAGR) of 12.3%. An initial investment of $1,000 in 1984 would be worth $131,186 today [1].

| Strategy: | Yieldstream | High Yield Index [2] |

|---|---|---|

| Compound Annual Growth Rate [1] | 12.3% | 7.0% |

| Standard Deviation [3] | 2.8% | 4.0% |

| Maximum Drawdown [5] | -3.6% | -34.0% |

| Sharpe Ratio [4] | 2.82 | 0.80 |

| Growth of $1,000 invested in 1984 | $131,186 | $17,253 |

By comparison, the benchmark portfolio (High-Yield Index) has a CAGR of 7.0%, annualized standard deviation of 4.0%, and Sharpe Ratio of 0.80. Note that the benchmark drawdowns (-34.0%) are significantly worse than the strategy drawdowns (-3.6%). In other words, a typical “buy-and-hold” high yield bond portfolio would have lost more than one third of its value (during the global financial crisis in 2008-2009), while the Yieldstream drawdown was barely noticeable.

Annual Performance

| Year | Yieldstream Strategy | High Yield Index |

|---|---|---|

| 1984 | 11.98% | 9.33% |

| 1985 | 23.32% | 25.67% |

| 1986 | 19.52% | 13.37% |

| 1987 | 8.25% | 2.21% |

| 1988 | 13.06% | 12.62% |

| 1989 | 8.04% | -0.56% |

| 1990 | 12.23% | -10.24% |

| 1991 | 34.47% | 36.51% |

| 1992 | 18.29% | 17.16% |

| 1993 | 21.70% | 18.37% |

| 1994 | 3.68% | -3.06% |

| 1995 | 19.21% | 17.49% |

| 1996 | 15.95% | 13.09% |

| 1997 | 15.39% | 13.50% |

| 1998 | 12.13% | -0.17% |

| 1999 | 10.08% | 5.04% |

| 2000 | 5.31% | -7.26% |

| 2001 | 14.67% | 2.38% |

| 2002 | 8.57% | -1.46% |

| 2003 | 20.32% | 24.05% |

| 2004 | 10.01% | 9.94% |

| 2005 | 5.30% | 2.61% |

| 2006 | 11.75% | 10.10% |

| 2007 | 9.36% | 1.29% |

| 2008 | 9.98% | -26.67% |

| 2009 | 55.04% | 45.55% |

| 2010 | 14.15% | 14.18% |

| 2011 | 7.30% | 2.75% |

| 2012 | 14.12% | 14.71% |

| 2013 | 8.00% | 6.93% |

| 2014 | 5.22% | 1.10% |

| 2015 | 2.40% | -4.06% |

| 2016 | 18.99% | 13.28% |

| 2017 | 5.33% | 6.42% |

| 2018 | 1.80% | -2.82% |

| 2019 | 10.08% | 12.52% |

| 2020 | 11.99% | 4.83% |

| 2021 | 6.58% | 4.81% |

| 2022 | 0.17% | -11.06% |

| 2023 | 8.45% | 11.72% |

| 2024 | 7.82% | 6.60% |

| 2025 | 8.75% | 7.70% |

| 2026 | 0.80% | 0.71% |

Monthly Strategy Performance

| Year | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1984 | 0.6 | -1.0 | -0.3 | -1.0 | 0.1 | 2.3 | 3.0 | 2.4 | 2.7 | 1.6 | 1.0 | 12.0% | |

| 1985 | 3.6 | 0.3 | 0.5 | 2.0 | 3.4 | 2.4 | 0.4 | 1.3 | 0.8 | 1.5 | 2.4 | 2.8 | 23.3% |

| 1986 | 0.8 | 4.3 | 3.5 | 1.8 | 0.7 | 1.0 | 0.7 | 1.5 | 0.3 | 1.5 | 1.1 | 0.8 | 19.5% |

| 1987 | 2.4 | 1.7 | 1.3 | -0.3 | 0.2 | 0.5 | 0.9 | -1.3 | 0.2 | 1.1 | -0.1 | 1.3 | 8.3% |

| 1988 | 2.9 | 3.2 | -0.3 | 0.7 | 0.1 | 1.5 | 1.2 | -0.1 | 1.6 | 1.1 | 0.1 | 0.5 | 13.1% |

| 1989 | 1.2 | 0.4 | 0.2 | 1.4 | 1.3 | 1.6 | 0.4 | -0.2 | -1.4 | 1.7 | 0.8 | 0.4 | 8.0% |

| 1990 | -0.1 | 0.5 | 0.3 | 0.1 | 2.2 | 2.0 | 2.8 | -0.5 | 0.8 | 1.0 | 1.4 | 1.0 | 12.2% |

| 1991 | 1.5 | 4.1 | 3.8 | 4.3 | 2.2 | 2.3 | 3.7 | 1.9 | 1.8 | 3.6 | 0.6 | 0.3 | 34.5% |

| 1992 | 3.6 | 2.8 | 2.6 | 1.2 | 1.6 | 1.4 | 1.6 | 1.3 | 0.9 | -1.3 | 0.9 | 0.5 | 18.3% |

| 1993 | 3.3 | 2.4 | 2.3 | 0.3 | 1.9 | 2.4 | 1.4 | 0.8 | -0.3 | 2.2 | 1.6 | 1.6 | 21.7% |

| 1994 | 4.4 | 0.3 | -1.1 | -0.4 | 0.2 | -0.0 | 0.7 | 0.5 | -0.1 | -0.3 | -0.6 | 0.2 | 3.7% |

| 1995 | 1.5 | 3.9 | 1.1 | 2.3 | 2.8 | 0.2 | 2.4 | 0.8 | 0.9 | -0.1 | 0.7 | 1.2 | 19.2% |

| 1996 | 2.8 | 1.3 | -0.0 | 0.3 | 1.2 | 0.4 | 0.3 | 1.7 | 3.0 | 0.8 | 1.6 | 1.6 | 16.0% |

| 1997 | 1.3 | 2.1 | -0.8 | 1.0 | 2.3 | 1.9 | 2.6 | 0.5 | 2.4 | 0.1 | 0.2 | 1.0 | 15.4% |

| 1998 | 2.0 | 1.1 | 1.5 | 0.5 | 0.2 | -0.0 | 0.5 | 0.4 | 1.1 | 0.3 | 4.6 | -0.5 | 12.1% |

| 1999 | 1.9 | 0.1 | 2.0 | 2.0 | -0.8 | 0.2 | 0.2 | 0.2 | 0.8 | 0.3 | 1.3 | 1.7 | 10.1% |

| 2000 | -0.5 | 0.5 | -0.2 | 0.1 | 0.3 | 1.2 | -0.1 | 0.3 | 0.6 | 0.5 | 1.1 | 1.3 | 5.3% |

| 2001 | 7.5 | 1.0 | -0.7 | 0.1 | 0.7 | -0.4 | 1.2 | 0.4 | 0.4 | 1.3 | 3.6 | -0.9 | 14.7% |

| 2002 | 0.2 | -0.4 | 2.0 | 1.0 | -0.1 | -0.0 | 1.2 | 0.6 | -0.2 | -0.2 | 3.8 | 0.4 | 8.6% |

| 2003 | 0.9 | 0.9 | 1.9 | 4.3 | 0.3 | 2.1 | -1.0 | 1.1 | 2.4 | 2.2 | 1.2 | 2.4 | 20.3% |

| 2004 | 2.1 | -0.8 | -0.3 | -1.1 | -0.4 | 1.0 | 1.2 | 1.7 | 1.3 | 1.9 | 1.7 | 1.4 | 10.0% |

| 2005 | -0.2 | 1.6 | -0.8 | 0.7 | 0.5 | 1.3 | 1.8 | 0.5 | -1.3 | -0.5 | 0.4 | 1.1 | 5.3% |

| 2006 | 1.3 | 0.8 | 0.6 | 1.3 | 0.1 | -0.5 | 0.8 | 1.4 | 1.1 | 1.6 | 1.5 | 1.3 | 11.8% |

| 2007 | 1.3 | 1.4 | 0.4 | 1.5 | 1.0 | -0.3 | 0.9 | 1.0 | 1.2 | 0.7 | -0.4 | 0.3 | 9.4% |

| 2008 | 2.0 | 0.8 | 0.3 | 2.6 | 0.4 | -0.4 | 0.3 | 0.5 | 0.4 | -0.2 | 1.4 | 1.5 | 10.0% |

| 2009 | 4.0 | -0.7 | 2.7 | 9.5 | 6.3 | 3.0 | 6.2 | 2.0 | 5.1 | 1.3 | 2.1 | 3.5 | 55.0% |

| 2010 | 1.0 | -0.9 | 4.1 | 2.4 | -3.1 | 0.0 | 3.1 | -0.5 | 3.3 | 3.0 | -0.3 | 1.5 | 14.1% |

| 2011 | 2.5 | 1.5 | 0.3 | 1.9 | 0.5 | -1.0 | 0.6 | -1.3 | -0.1 | 2.7 | -2.2 | 1.8 | 7.3% |

| 2012 | 2.8 | 2.4 | 0.1 | 0.9 | -1.0 | 0.8 | 1.8 | 1.5 | 1.5 | 0.9 | 0.3 | 1.3 | 14.1% |

| 2013 | 1.6 | 0.6 | 1.2 | 1.8 | -0.2 | -0.4 | 0.4 | -0.4 | 0.1 | 1.9 | 0.7 | 0.6 | 8.0% |

| 2014 | 0.8 | 1.9 | 0.3 | 0.8 | 1.1 | 0.8 | -0.1 | 0.2 | -0.5 | 0.0 | -0.1 | 0.0 | 5.2% |

| 2015 | -0.0 | 2.3 | -0.5 | 1.4 | 0.6 | -1.4 | 0.0 | 0.0 | 0.0 | 0.5 | -0.5 | 0.0 | 2.4% |

| 2016 | 0.0 | 0.0 | 2.0 | 4.6 | 2.1 | 0.9 | 2.7 | 2.9 | 0.2 | 0.8 | -0.3 | 1.8 | 19.0% |

| 2017 | 0.7 | 0.9 | -0.6 | 0.9 | 0.8 | 0.5 | 1.5 | -0.4 | 0.7 | 0.3 | -0.5 | 0.4 | 5.3% |

| 2018 | 0.7 | -0.5 | 0.1 | 0.1 | 0.2 | -0.2 | 0.6 | 0.7 | 0.4 | -0.7 | 0.2 | 0.2 | 1.8% |

| 2019 | 1.9 | 1.5 | 0.9 | 1.7 | -0.9 | 1.1 | 0.4 | 0.3 | 0.7 | -0.1 | 0.6 | 1.8 | 10.1% |

| 2020 | 0.2 | -0.2 | 0.1 | -1.1 | 2.4 | 0.8 | 4.2 | 0.8 | -1.7 | 0.3 | 3.4 | 2.4 | 12.0% |

| 2021 | 0.9 | 1.3 | -0.0 | 1.8 | 0.2 | 0.8 | 0.1 | 0.5 | 0.2 | 0.5 | -0.2 | 0.2 | 6.6% |

| 2022 | -0.9 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.7 | -0.8 | -0.4 | 0.2 | 1.6 | -0.4 | 0.2% |

| 2023 | 3.1 | -1.9 | -0.2 | 1.3 | -1.1 | 2.4 | 1.5 | 0.6 | -1.8 | -0.1 | 1.6 | 2.7 | 8.4% |

| 2024 | 0.5 | 0.6 | 1.1 | -0.8 | 0.5 | 0.8 | 1.5 | 1.3 | 1.1 | -0.2 | 1.2 | -0.1 | 7.8% |

| 2025 | 0.4 | 0.4 | -1.3 | 1.4 | 1.3 | 1.8 | 0.6 | 1.6 | 0.7 | 0.1 | 0.7 | 0.6 | 8.7% |

| 2026 | 0.8 | 0.8% |

Notes

- Yieldstream was made available to subscribers on 7/7/2011. Performance results before this date are a hypothetical strategy backtest. Strategy signals since 10/21/2011 are tracked and verified by TimerTrac.com. Note that TimerTrac does not support tracking of the individual mutual funds we use in the Yieldstream portfolio, so they track only our strategy signals: switching between a low volatility and high yield bond ETF. As a result, the tracked performance will be lower, but still confirms when our strategy issued its signals. Recent signals are shown only to current subscribers.

- In the long term, high-yield bonds offer the highest total bond returns, which makes a high-yield bond index a good proxy for the maximum return that a fixed income investor can attain.

- Standard deviation, also known as historical volatility, is used by investors to measure portfolio volatility. Volatile funds or portfolios have a high standard deviation. When comparing investments, a low standard deviation is preferable.

- The Sharpe Ratio measures risk-adjusted performance. It’s calculated by subtracting the risk-free interest rate from the rate of return for a specific portfolio, and dividing the result by the standard deviation of the portfolio returns. We use U.S. Treasury Bill returns as our risk-free investment. When comparing portfolios, a high Sharpe Ratio is preferable.

- Drawdown: the peak-to-trough decline in investment or portfolio value, measured as a percentage between the peak and the trough. A good investment strategy aims to minimize drawdowns.

- An investor following the Yieldstream strategy typically submits the rebalancing orders after the market close or during the next business day. These performance results incorporate this 1-day delay. The reported strategy allocation changes are also delayed by a day, and show the date on which fund orders were actually executed (Yieldstream subscribers receive these signals on the previous day).

- These performance results do not incorporate the expense of mutual fund trading comissions, which vary by broker and by fund. While every individual investor's situation is unique, we've estimated the impact of these expenses in this post. (Please read the section "Impact of trading commissions").

Yieldstream Strategy

Learn more about subscribing to the Yieldstream strategy