In this post, we’ll take a look at the performance of our tactical High Yield bond strategy during periods of rising interest rates. First, a brief overview. Below is a chart that shows the interest rate of 3-month Treasury Bills since 1954: Short-term interest rates (as represented by 3-month T-Bills) have fluctuated in a wide range. After World War II, rates were very low (less than one...

[more]

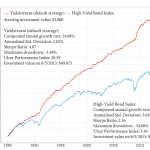

Readers often ask whether our Yieldstream strategy works in smaller investment accounts. They inquire about the performance impact of holding just one fund at a time (instead of all 3 in our model portfolio), and wonder whether there’s any way to reduce trading expenses (brokerage fund commissions). In this post, we take a closer look at several variations on the Yieldstream strategy which address...

[more]

There’s no single best answer to how to construct and manage a bond portfolio. There are several options that will appeal to different types of investors. The simplest possible way to invest in bonds is to buy a diversified bond fund. For example, you can buy the Vanguard Total Bond Market Index Fund (VBMFX). This mutual fund replicates the investment performance of the Barclays Capital U.S. Aggregate Bond Index, which represents the broad U.S. bond market. Just by buying this single...

[more]

Investors know that stocks are very different from bonds. But due to the persistent low interest rate environment, aging investors have more and more turned to both dividend stocks and high yield bonds as a source of fixed income for their retirement. Let’s take a look at how these two very different investments compare. Dividend Yield An investment in high yield bonds will almost always give...

[more]

Most investors are familiar with investment grade bonds: they’re IOUs from a company or government organization, with an agreed-upon interest rate (how much it will pay you) and maturity date (when it will pay you back your principal). What makes high yield bonds different is the lower credit quality of their issuers, as determined by various rating agencies. These bonds pay high yields to compensate...

[more]

On our performance page, we show how the Yieldstream strategy has done since 1984. But bond mutual funds, including high yield bond funds, have been around a lot longer than that. For example, Northeast Investors Trust (NTHEX) has been available to investors since 1950. We thought it would be interesting to share how the Yieldstream strategy has performed since 1950: Strategy: Yieldstream High Yield Index Compound Annual Growth Rate 12.2%...

[more]

The table below lists the bond funds used most commonly by the Yieldstream strategy since inception, and the best broker to use when purchasing a fund. Overall, the best online brokers to use with Yieldstream are Charles Schwab and TD Ameritrade. They provide access to the broadest range of available bond funds, and the most reasonable fees. (Note: we do NOT receive any compensation for recommending these brokers). We believe this information to be accurate (as of June 2011), but broker...

[more]

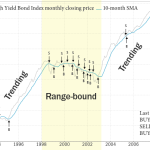

We saw earlier how a simple trend-following strategy can capture most of the high yield market’s good times and miss most of its bad times, by switching out of high-yield bond funds and into lower volatility bonds when the going gets rough. The chart below shows this same trend-following strategy, using a 10-month Simple Moving Average (SMA), but this time we've applied it to a high-yield bond...

[more]

Trend-following is an active investment strategy that works well on many different asset classes such as stocks, bonds, real estate, commodities, and currencies. The effectiveness of trend-following is supported by academic and practitioner research, published in hundreds of papers and investment books over the past decades. We won't attempt to summarize the trend-following literature, but encourage...

[more]

The high yield bond market has a long history of successful actively managed strategies. We first learned about high yield investment models from a professional money manager with hundreds of millions of dollars under management, who has managed client money in high yield bond strategies since the early 1990s. Actively managed high yield strategies have been used for decades. Original high yield market timers used very simple strategies. For example, some looked for a penny…

[more]

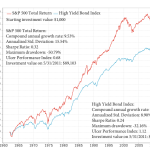

We’ll take a look at how investing in high yield bonds compares to investing in U.S. stocks. High yield bonds, also known as junk bonds, are often associated with negative connotations: Credit risk. Defaults. Older investors may remember the scandal surrounding Michael Milken (a.k.a. the Junk Bond King). Asset allocation gurus often discourage investing in corporate bonds (including high yield)...

[more]

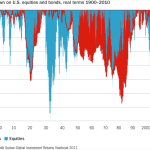

Many investors operate under the mistaken assumption that bonds offer a steady return and are less risky than other asset classes like stocks and real estate. Most financial advisors also recommend that their clients invest in bonds in order to reduce the volatility and risk of their portfolio. For the most part, this has worked well during the past 30 years. Between 1980 and 2010, the annualized real...

[more]

Yieldstream Strategy

Learn more about subscribing to the Yieldstream strategy