Many investors operate under the mistaken assumption that bonds offer a steady return and are less risky than other asset classes like stocks and real estate. Most financial advisors also recommend that their clients invest in bonds in order to reduce the volatility and risk of their portfolio.

For the most part, this has worked well during the past 30 years. Between 1980 and 2010, the annualized real (inflation-adjusted) return on U.S. government bonds was 6.0%. And bonds provided welcome diversification during stock bear markets [1]. The primary reason for the excellent bond returns during this period is the high interest rate and bond yields in the early 1980s (over 16 percent at their peak). Interest rates declined over the subsequent decades, helping to propel the total return of bonds.

But bond investors who look only at the past 30 years may be lulled into a false sense of security: from 1900-1980, U.S. government bonds provided an annualized real return of only 0.2%. That’s right, 0.2% per year for 80 years [2]. Looking at interest rates again during this period, they rose from Great Depression lows towards their peak in the 1980s.

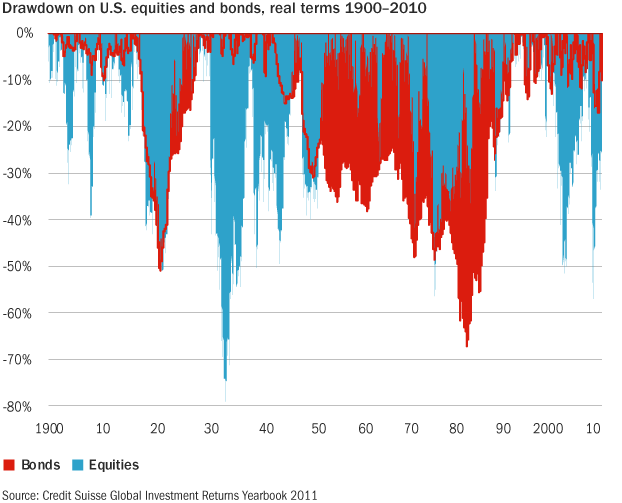

OK, but at least bonds have been a lot less risky investment, right? Wrong again. Comparing the drawdowns [3] of U.S. stocks to bonds has also not been a pretty picture:

Emerging from a U.S. Federal Reserve policy designed to artificially supress interest rates near historical lows, it’s unlikely that during the coming decades, U.S. bonds will repeat the performance that they’ve offered between 1980-2010. And it’s quite possible that buy-and-hold bond investors will once again experience painful periods of high risk and volatility.

In this context, a tactical asset allocation strategy to invest in bonds will probably add significant value during the coming decades.

Notes

- Credit Suisse Global Investment Returns Yearbook 2011, page 6

- Credit Suisse Global Investment Returns Yearbook 2011, page 7

- Drawdown is defined in this Credit Suisse report as: "the cumulative percentage decline in real value from an index high to successive subsequent dates. This indicates just how bad an investor’s experience might have been if the investor had the misfortune to buy at the top of a bull market."

Comments

To add a comment, please Sign In.