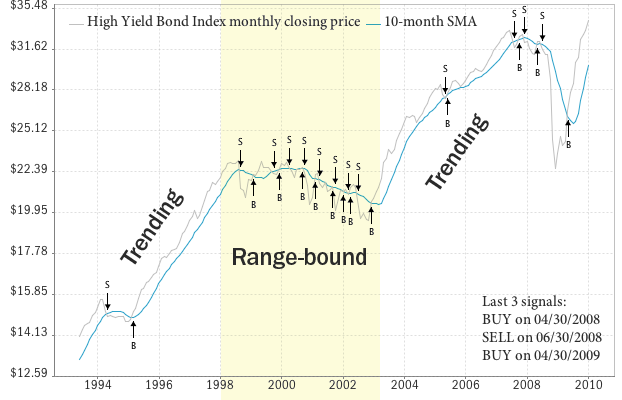

We saw earlier how a simple trend-following strategy can capture most of the high yield market’s good times and miss most of its bad times, by switching out of high-yield bond funds and into lower volatility bonds when the going gets rough. The chart below shows this same trend-following strategy, using a 10-month Simple Moving Average (SMA), but this time we've applied it to a high-yield bond index.

Between 1994 and 2010, the market completed several cycles, alternating between trending and declining or range-bound periods. One weakness of trend-following strategies is the tendency to issue many false signals during range-bound markets. The high-yield market was essentially range-bound between 1998 and 2003:

Note: we use a more sophisticated trend-following approach in the Yieldstream strategy, but this simple SMA strategy serves as a good example.

As you can see, during this range-bound period, the SMA strategy issued many more buy and sell signals than usual. Trend-followers refer to these false signals as "whipsaws." They’re so common that Ed Seykota, a legendary trend-follower, has even written a song about whipsaws.

To succeed at trend-following, it's essential that the investor sticks with the strategy during these periods, and follows ALL signals, no matter how frequent. Good trend-following strategies get you out of a position quickly if it moves against you. When a market starts moving down, you never know in advance how deep the correction will be. Waiting around to find out can do significant damage to your investment account. Cutting your losses quickly, and "riding your winners" is essential to successful trend-following. Whipsaws may be frustrating, but it's only a matter of time before the trend resumes, and as Ed Seykota says: "one good trend pays for them all."

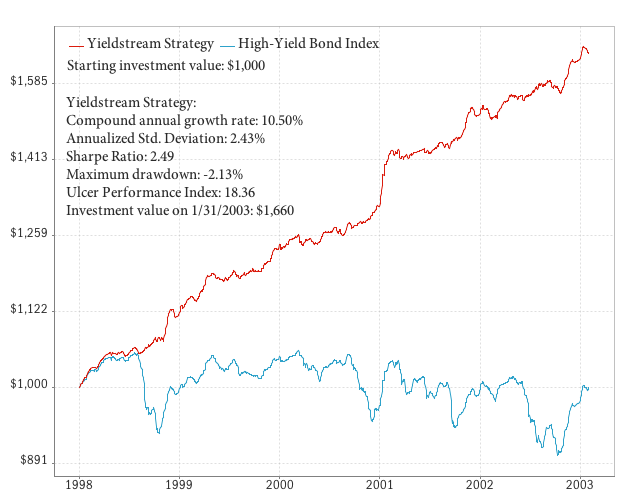

No investment strategy is perfect. Yieldstream also has its whipsaws. Following the "Flash Crash" in May 2010, it took the high yield bond market a couple of months to recover and resume its upward trend. During this period, markets were choppy, and there were 5 Yieldstream buy/sell signals, a few of them in rapid succession. The 1998-2003 period was also a challenge for Yieldstream, with more frequent buy/sell signals than usual, especially during 2001-2002. Still, Yieldstream performed reasonably well during this period:

As you can see, Yieldstream managed to squeeze out a 10.50% compound annual return, during a period when a buy-and-hold investor of high-yield bonds had a zero net return.

Comments

To add a comment, please Sign In.